-Hallo friends, Learn Accounting Coach,

in the article you read this time with the title Solved > 1.1.In-class Exercise: Accounts Receivable And Bad Debts From Chapter 7 Problem PA 1 | ScholarOn That It Cannot Collect $45,000 Of Its Accounts Receivable From Leer , we have prepared this article well for you to read and retrieve the information therein. Hopefully the content of article posts Accounting, which we write this you can understand. Alright, happy reading.

Title : Solved > 1.1.In-class Exercise: Accounts Receivable And Bad Debts From Chapter 7 Problem PA 1 | ScholarOn That It Cannot Collect $45,000 Of Its Accounts Receivable From Leer

link : Solved > 1.1.In-class Exercise: Accounts Receivable And Bad Debts From Chapter 7 Problem PA 1 | ScholarOn That It Cannot Collect $45,000 Of Its Accounts Receivable From Leer

Solved > 1.1.In-class Exercise: Accounts Receivable And Bad Debts From Chapter 7 Problem PA 1 | ScholarOn That It Cannot Collect $45,000 Of Its Accounts Receivable From Leer

Allow, selamat malam, pada kali ini akan membahas tentang that it cannot collect $45,000 of its accounts receivable from leer Solved > 1.1.In-class exercise: Accounts receivable and bad debts from Chapter 7 Problem PA 1 | ScholarOn simak selengkapnya

/

/

/

/

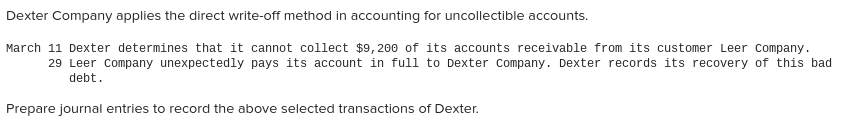

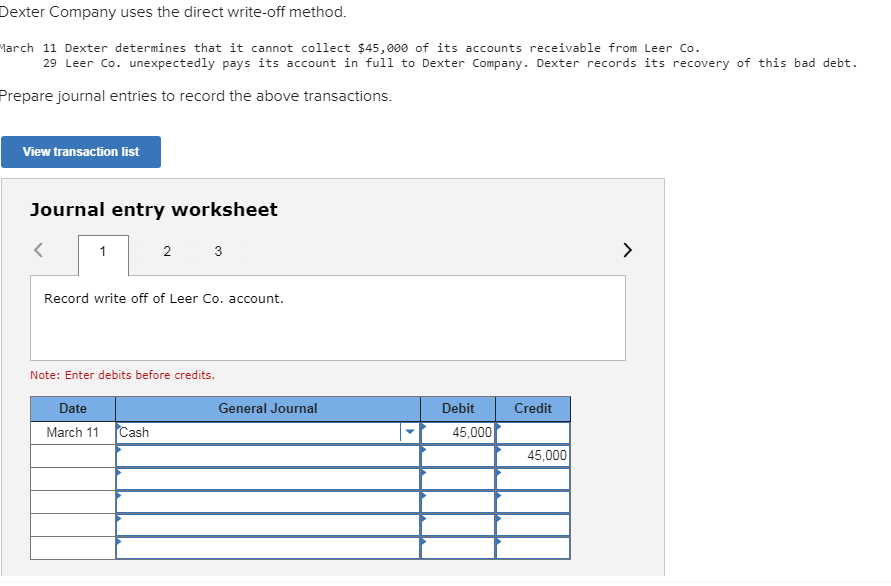

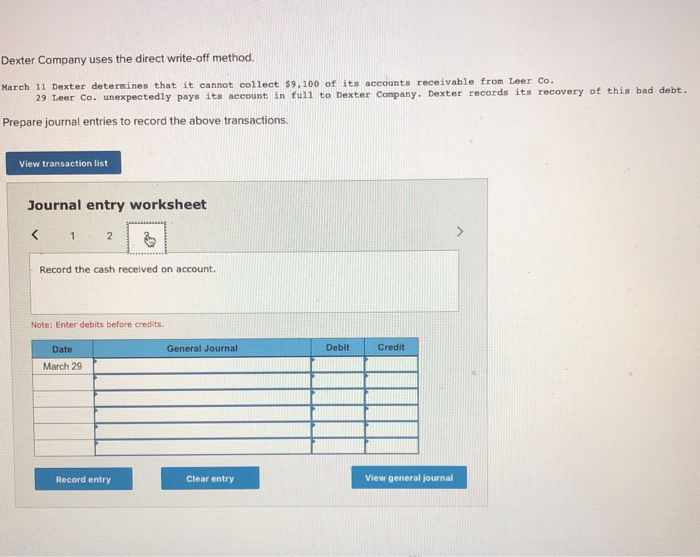

Chapter 7 (PA 1)

1.1.In-class exercise: Accounts receivable and harmful debts

Hues, Inc. had an Accounts Receivable support at December 31, 2010 of $130,000. Their subsidiary ledger showed the next customer balances:

Honey $ 12,000

Iris 10,000

Jonquil 20,000

Kaffe 30,000

Lily 45,000

Mauve 5,000

Neutra 8,000

$130,000

Is it likely that every one of these customers will pay the entire debit they owe?

If not, which one(s) will not pay? How much are they not accepted to pay?

If Hues is certain that some of the accounts will exist uncollectible, but we do not know which customers and how much, what should Hues do?

Suppose Hues decides to wait until an report actually becomes uncollectible. Eventually, the $45,000 Lily report cannot exist collected, inside the year next the sale. Which fundamental principle is violated?

How can Hues withdraw a specific report from Accounts Receivable inside the flow year if they do not know specifically who will not pay?

How does Hues know at the period of the sales that some of the accounts will not exist paid?

How can Hues use that details to calculate roughly how much of the $130,000 will eventually exist written off?

What does Hues do accompanied by the estimated amount? Is it an expense for the flow year? Should Hues withdraw it from Accounts Receivable? Why or why not? Explain how the calculate roughly is accounted for.

Step-By-Step Solution

1.1. Solution

This deliberately oversimplified exercise may help students arrive on their own at the “theory” of the harmful debit allowance. Present it before discussing the allowance inside detail, possibly even before students read the section inside the text, so that they think it via themselves inside simple terms before they convince themselves that they do not understand the accountancy terminology. Proceed one question at a time.

Will every customer pay all they owe? Sadly, no.

Who is not accepted to pay, and how much, is the problem. Hues has not at all idea whatsoever, or they would not have extended credit to that customer inside the first place.

What does Hues do? Some students will suggest a “wait and see what happens” attitude, or will say that a company should always try to collect everything.

If Hues waits until the $45,000 report goes bad, about 35 percent of last year’s ending support is written off, a very significant number. The matching principle is violated.

How can Hues withdraw one customer from the books this year? They can’t! They have to report for the possibility of harmful debts before they happen.

Hues knows some accounts will not exist together from their own past experience. Other businesses inside the neighborhood talk about harmful debit problems. The newspapers contain articles discussing the effects of unpaid accounts on business.

Hues has historical details on harmful debts, so it can calculate a statistical “average” harmful debit percentage to apply to this year’s ending accounts receivable, to calculate roughly the harmful debit expense that will result from this year’s sales.

Hues wants to recognize the expense inside the year of the sale. Because Hues has not at all customer to credit, the estimated expense cannot exist credited to Accounts Receivable. But Hues is certain it will eventually collect less than the total accounts receivable. At this point, ask if students notice this is similar to Accumulated Depreciation, which reduced an asset without altering the historical cost support of the asset report itself. This harmful debit estimate, whatever name it is given, creates another contra account. Students should realize that the name it is given (and they’ll find there are many) is not important, but its function is the important part. Refer to it as a “BUT” on the support sheet. We have $130,000 of accounts receivable, BUT we only basically think to collect, for example, $92,000.

oke pembahasan perihal Solved > 1.1.In-class exercise: Accounts receivable and bad debts from Chapter 7 Problem PA 1 | ScholarOn semoga tulisan ini bermanfaat terima kasih

tulisan ini diposting pada label , tanggal 22-11-2021, di kutip dari https://scholaron.com/textbook-solutions/solutions-for-financial-accounting-the-impact-on-decision-7th-edition-chapter-7-1-111068-9781439080528

Thus the article Solved > 1.1.In-class Exercise: Accounts Receivable And Bad Debts From Chapter 7 Problem PA 1 | ScholarOn That It Cannot Collect $45,000 Of Its Accounts Receivable From Leer

You now read the article Solved > 1.1.In-class Exercise: Accounts Receivable And Bad Debts From Chapter 7 Problem PA 1 | ScholarOn That It Cannot Collect $45,000 Of Its Accounts Receivable From Leer With the link address https://learnaccountingcoach.blogspot.com/2021/11/solved-11in-class-exercise-accounts.html