-Hallo friends, Learn Accounting Coach,

in the article you read this time with the title Calculate Expense Of Bad Debts & Estimated Uncollectibles.pdf - Estimates Of Bad Debts Estimated Uncollectible \u2022 In Every Company Some Customer | Course Hero How To Calculate Total Estimated Uncollectibles, we have prepared this article well for you to read and retrieve the information therein. Hopefully the content of article posts Accounting, which we write this you can understand. Alright, happy reading.

Title : Calculate Expense Of Bad Debts & Estimated Uncollectibles.pdf - Estimates Of Bad Debts Estimated Uncollectible \u2022 In Every Company Some Customer | Course Hero How To Calculate Total Estimated Uncollectibles

link : Calculate Expense Of Bad Debts & Estimated Uncollectibles.pdf - Estimates Of Bad Debts Estimated Uncollectible \u2022 In Every Company Some Customer | Course Hero How To Calculate Total Estimated Uncollectibles

Calculate Expense Of Bad Debts & Estimated Uncollectibles.pdf - Estimates Of Bad Debts Estimated Uncollectible \u2022 In Every Company Some Customer | Course Hero How To Calculate Total Estimated Uncollectibles

Hi, selamat sore, pada kali ini akan membawa pembahasan mengenai how to calculate total estimated uncollectibles Calculate expense of bad debts & estimated uncollectibles.pdf - Estimates of bad debts Estimated uncollectible \u2022 In every company some customer | Course Hero simak selengkapnya

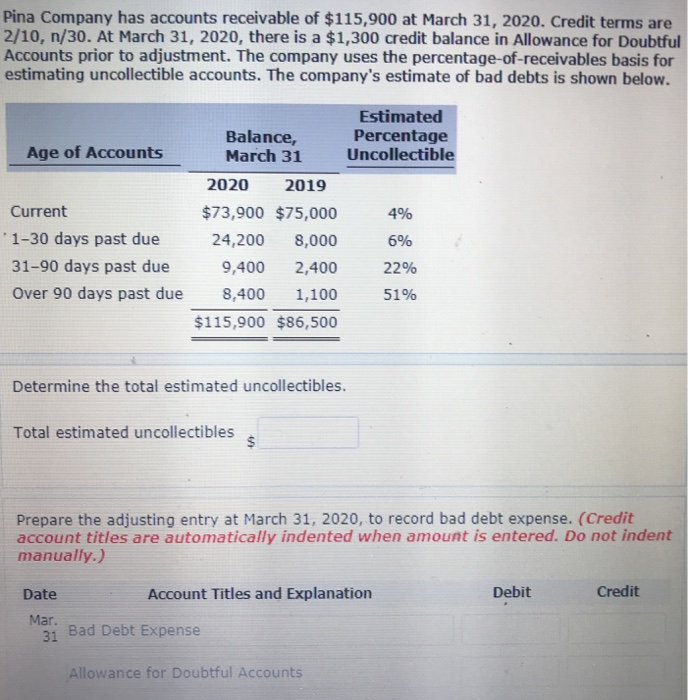

Estimates of bad debts & Estimated uncollectible • In every firm some customer will buy good/service from them in Credit and that credit quantity is called account receivable. • And firm will do a current while period to pay the quantity , then they will consider it as due • Sometimes customers will not pay the quantity in full and the firm will become forced to do some adjustment in the amount, For example Company sold a good to customer in credit of 10000 and customer after two months the customer paid 9500. Then firm will adjust remaining 500 from account and that quantity is called Bad debts. • Estimated uncollectible : Most of the companies have a fixed percentage to calculate the bad debts, that percentage is calculated using the Bad debts trends of previous y7ear. The percentage is called percentage of uncollectable For example, as per the previous year bad debts auditor will decided to give 5% bad debt for their customers. And estimated uncollectable can be

begitulah detil tentang Calculate expense of bad debts & estimated uncollectibles.pdf - Estimates of bad debts Estimated uncollectible \u2022 In every company some customer | Course Hero semoga tulisan ini bermanfaat salam

tulisan ini diposting pada tag , tanggal 22-11-2021, di kutip dari https://www.coursehero.com/file/93361352/Calculate-expense-of-bad-debts-estimated-uncollectiblespdf/

Thus the article Calculate Expense Of Bad Debts & Estimated Uncollectibles.pdf - Estimates Of Bad Debts Estimated Uncollectible \u2022 In Every Company Some Customer | Course Hero How To Calculate Total Estimated Uncollectibles

You now read the article Calculate Expense Of Bad Debts & Estimated Uncollectibles.pdf - Estimates Of Bad Debts Estimated Uncollectible \u2022 In Every Company Some Customer | Course Hero How To Calculate Total Estimated Uncollectibles With the link address https://learnaccountingcoach.blogspot.com/2021/11/calculate-expense-of-bad-debts.html