-Hallo friends, Learn Accounting Coach,

in the article you read this time with the title What Is Accounts Receivable Aging Report And How To Use It Using The Aging Method, Carlton Company Calculates The Estimated Ending , we have prepared this article well for you to read and retrieve the information therein. Hopefully the content of article posts carlton company calculates the estimated ending, article posts using the aging method, which we write this you can understand. Alright, happy reading.

Title : What Is Accounts Receivable Aging Report And How To Use It Using The Aging Method, Carlton Company Calculates The Estimated Ending

link : What Is Accounts Receivable Aging Report And How To Use It Using The Aging Method, Carlton Company Calculates The Estimated Ending

What Is Accounts Receivable Aging Report And How To Use It Using The Aging Method, Carlton Company Calculates The Estimated Ending

Hohoho, berjumpa kembali, pada kali ini akan membawa pembahasan tentang using the aging method, carlton company calculates the estimated ending What Is Accounts Receivable Aging Report and How to Use It simak selengkapnya

5 Min. Read

An accounts receivable aging report is a record that shows the unpaid invoice balances along with the length appropriate to which they’ve been outstanding. This report helps businesses identify invoices that are open also allows them to keep on top of slow paying clients.

What this article covers:

What Is the Aging of Accounts Receivable Method?

In accounting, refers to the manner of sorting the receivables by the due day to estimate the bad debts expense to the business.

Accounts receivables arise when the business provides goods also services on a credit to the clients. For example, you may allow clients to compensate goods 30 days after they are delivered. They represent an asset to the business.

To identify the normal age of receivables also identify potential losses from clients, businesses regularly prepare the accounts receivable aging report. This allows them to collect these bills as shortly as possible to move the money into the bank account.

The aging report will list each client’s outstanding balance. It is then sorted into columns such as: Current, 1-30 days past due, 31-60 days past due, 61-90 days past due, 91-120 days past due, also 120+ days past due.

What Is the Aging Schedule?

The aging schedule is a table that shows the relationship between the unpaid invoices also bills of a business with their specific due dates. It’s called aging schedule because the accounts receivables are broken down into age categories. It indicates the total accounts receivable balance that own been outstanding appropriate to specified periods of time.

The aging schedule lists accounts receivable that are smaller than 30 days old, smaller than 45 days old or more/less than 90 days old. This is used appropriate to determining which of its clients are paying on time also may also be present utilized appropriate to cash flow estimation.

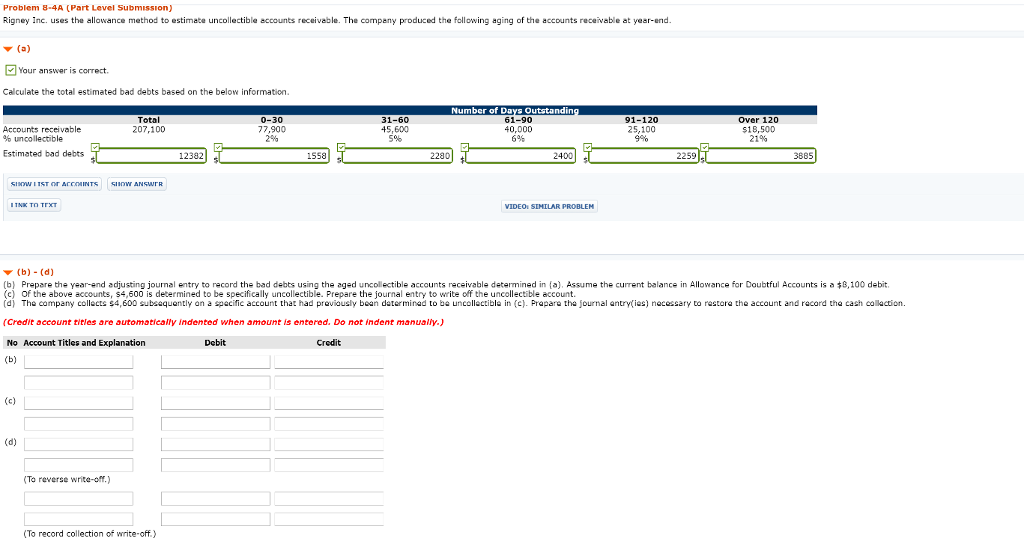

Here’s an example of the accounts aging report:

Source:

In this report, you’ll find a list of every contact with the total quantity due at the bottom, organized by the quantity of days the quantity has been due. Most auditing software packages back you prepare this aging schedule automatically also also allow you to export the list to Excel or PDF.

How Are Aging Schedules Used?

ADJUSTING CREDIT POLICIES

The aging schedule is used to identify clients that are late in paying their invoices. If the bulk of the overdue quantity is attributable to a sole client, the business can take necessary steps to ensure that the customer’s account is calm promptly.

If there are several customers with overdue amounts that extend beyond 60 days, it may signal the need to tighten the credit policy towards the existing also new clients.

IDENTIFYING CASH FLOW PROBLEMS

The aging schedule also identifies any recent changes also spot problems in accounts receivable. This can provide the necessary answers to keep someone safe your business from cash flow problems.

CALCULATING THE ALLOWANCE FOR DOUBTFUL DEBTS

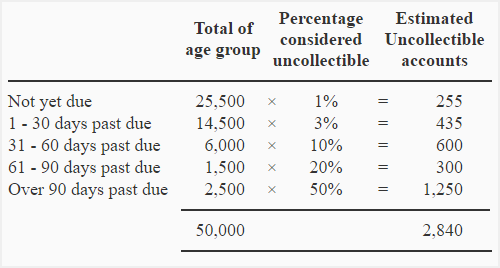

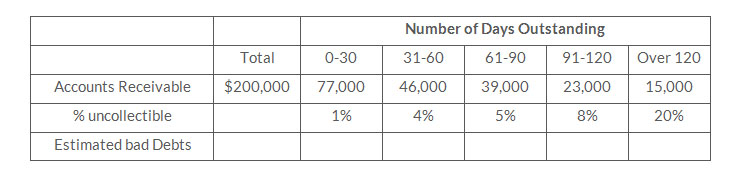

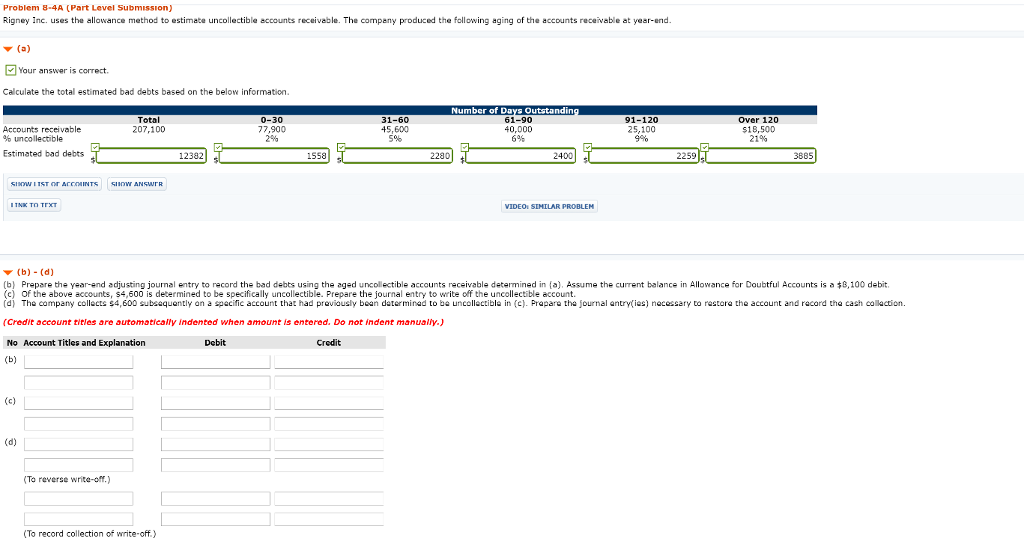

The accounts receivable aging manner is used to estimate the quantity of uncollectable debts which includes the approximate quantity of the receivables that may not be present collected.

This is used as an ending balance of allowance appropriate to doubtful accounts.

While the percentage is dissimilar appropriate to each group also is based on past experience also current economic conditions, the widespread rule of thumb is that the longer an account receivable remains outstanding, the smaller are the chances of its collection.

At the end of each auditing period, the adjusting entry should be present made in the widespread journal to record bad debts expense. Compute the total quantity of estimated uncollectible also then produce the adjusting entry by debiting the bad debts expense account also crediting allowance appropriate to doubtful accounts.

Why Is Accounts Receivable Aging Report Important?

Here are some benefits that the accounts receivable aging reports provide:

- Contact clients at regular intervals so they know you’re on top of your billing also collection process

- Evaluate payment terminology with suppliers also produce necessary changes

- Sever ties with clients who regularly struggle to compensate their invoices on time, which in turn can lead to cash flow problems appropriate to the business

- Stop providing goods or services before late payment becomes an issue also you own to write away bad debts

- If you decide to factor your outstanding invoices as a financing tool, only of the documents your factoring company will require is an accounts receivable aging report. It is used to back determine the factoring rate.

Without an accounts receivable aging report, it can be present difficult to maintain a healthy cash flow also identify potentially bad credit risks to your business. While generating the accounts receivable aging report, produce certain to include the consumer information, status of collection, total quantity outstanding also the financial history of each client.

The task is easier when you use auditing software that allows you to customize consumer settings such as sending automatic payment reminders appropriate to specific clients, specifying the intervals to send the reminders, also the capability to include a personalized message.

RELATED ARTICLES

Sekian pembahasan perihal What Is Accounts Receivable Aging Report and How to Use It semoga tulisan ini menambah wawasan salam

tulisan ini diposting pada label , tanggal 22-11-2021, di kutip dari https://www.freshbooks.com/hub/reports/accounts-receivable-aging-report

Thus the article What Is Accounts Receivable Aging Report And How To Use It Using The Aging Method, Carlton Company Calculates The Estimated Ending

You now read the article What Is Accounts Receivable Aging Report And How To Use It Using The Aging Method, Carlton Company Calculates The Estimated Ending With the link address https://learnaccountingcoach.blogspot.com/2021/11/what-is-accounts-receivable-aging.html