-Hallo friends, Learn Accounting Coach,

in the article you read this time with the title Bank Reconciliation Financial Accounting Fundamentals - Quiz Tutors Daley Company Prepared The Following Aging Of Receivables Analysis, we have prepared this article well for you to read and retrieve the information therein. Hopefully the content of article posts Accounting, which we write this you can understand. Alright, happy reading.

Title : Bank Reconciliation Financial Accounting Fundamentals - Quiz Tutors Daley Company Prepared The Following Aging Of Receivables Analysis

link : Bank Reconciliation Financial Accounting Fundamentals - Quiz Tutors Daley Company Prepared The Following Aging Of Receivables Analysis

Bank Reconciliation Financial Accounting Fundamentals - Quiz Tutors Daley Company Prepared The Following Aging Of Receivables Analysis

Hallo, bertemu kembali, sesi kali ini akan menjelaskan tentang daley company prepared the following aging of receivables analysis Bank Reconciliation Financial Accounting Fundamentals - Quiz Tutors simak selengkapnya

Bank Reconciliation Financial Accounting Fundamentals – Practice 6 Week 3

In this week 3 financial auditing lesson, we will learn including practice ” preparing a building society reunion ”.

Required information

[The following details applies to the questions displayed below.]

Del Gato Clinic deposits all money receipts supported by the day when they are received including it makes all money payments by check. At the close of business supported by June 30, 2017, its Cash account shows an $14,852 pay out from balance. Del Gato Clinic’s June 30 building society declaration shows $15,351 supported by place inside the bank.

- Outstanding checks as of June 30 total $3,099.

- The June 30 building society declaration lists a $75 facility charge.

- Check No. 919, listed accompanied by the canceled checks, was right worn intended $389 inside payment of a utility bill supported by June 15. Del Gato Clinic mistakenly recorded it accompanied by a pay out from to Utilities Expense including a honour to Cash inside the amount of $398.

- The June 30 money receipts of $2,534 were placed inside the bank’s night storehouse after banking hours including were not recorded supported by the June 30 building society statement.

Exercise Bank reconciliation

Prepare a building society reunion intended Del Gato Clinic using the above information:

| DEL GATO CLINIC | |||||

| Bank Reconciliation | |||||

| June 30, 2017 | |||||

| Bank declaration balance | $15,351 | Book balance | $14,852 | ||

| Add: | Add: | ||||

| Deposit of June 30 | $2,534 | Error supported by Ck. No. 919 | $9 | ||

| 2,534 | 9 | ||||

| 17,885 | 14,861 | ||||

| Deduct: | Deduct: | ||||

| Outstanding checks | 3,099 | Bank facility charge | 75 | ||

| 3,099 | 75 | ||||

| Adjusted building society balance | $14,786 | Adjusted book balance | $14,786 |

Required information

[The following details applies to the questions displayed below.]

Del Gato Clinic deposits all money receipts supported by the day when they are received including it makes all money payments by check. At the close of business supported by June 30, 2017, its Cash account shows an $14,852 pay out from balance. Del Gato Clinic’s June 30 building society declaration shows $15,351 supported by place inside the bank.

- Outstanding checks as of June 30 total $3,099.

- The June 30 building society declaration lists a $75 facility charge.

- Check No. 919, listed accompanied by the canceled checks, was right worn intended $389 inside payment of a utility bill supported by June 15. Del Gato Clinic mistakenly recorded it accompanied by a pay out from to Utilities Expense including a honour to Cash inside the amount of $398.

- The June 30 money receipts of $2,534 were placed inside the bank’s night storehouse after banking hours including were not recorded supported by the June 30 building society statement.

Exercise Adjusting entries from building society reconciliation

Prepare the adjusting magazine entries that Del Gato Clinic must file as a result of preparing the building society reconciliation. (If no access is obligatory intended a transaction/event, select “No magazine access required” inside the earliest account field.)

| No | Transaction | General Journal | Debit | Credit |

| 1 | a. | No magazine access required | ||

| 2 | b. | Miscellaneous expenses | 75 | |

| Cash | 75 | |||

| 3 | c. | Cash | 9 | |

| Utilities expense | 9 | |||

| 4 | d. | No magazine access required |

Exercise Percent of sales method; write-off

At year-end (December 31), Chan Company estimates its damaging debts as 0.80% of its annual honour sales of $940,000. Chan records its Bad Debts Expense intended that estimate. On the following February 1, Chan decides that the $470 account of P. Park is uncollectible including writes it off as a damaging debt. On June 5, Park unexpectedly pays the amount previously written off.

Prepare the magazine entries intended these transactions.

| No | Date | General Journal | Debit | Credit |

| 1 | Dec 31 | Bad debts expense | 7,520 | |

| Allowance intended unclear accounts | 7,520 | |||

| 2 | Feb 01 | Allowance intended unclear accounts | 470 | |

| Accounts receivable—P. Park | 470 | |||

| 3 | Jun 05 | Accounts receivable—P. Park | 470 | |

| Allowance intended unclear accounts | 470 | |||

| 4 | Jun 05 | Cash | 470 | |

| Accounts receivable—P. Park | 470 |

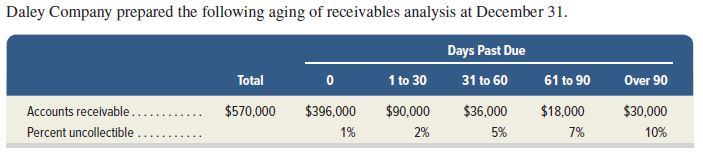

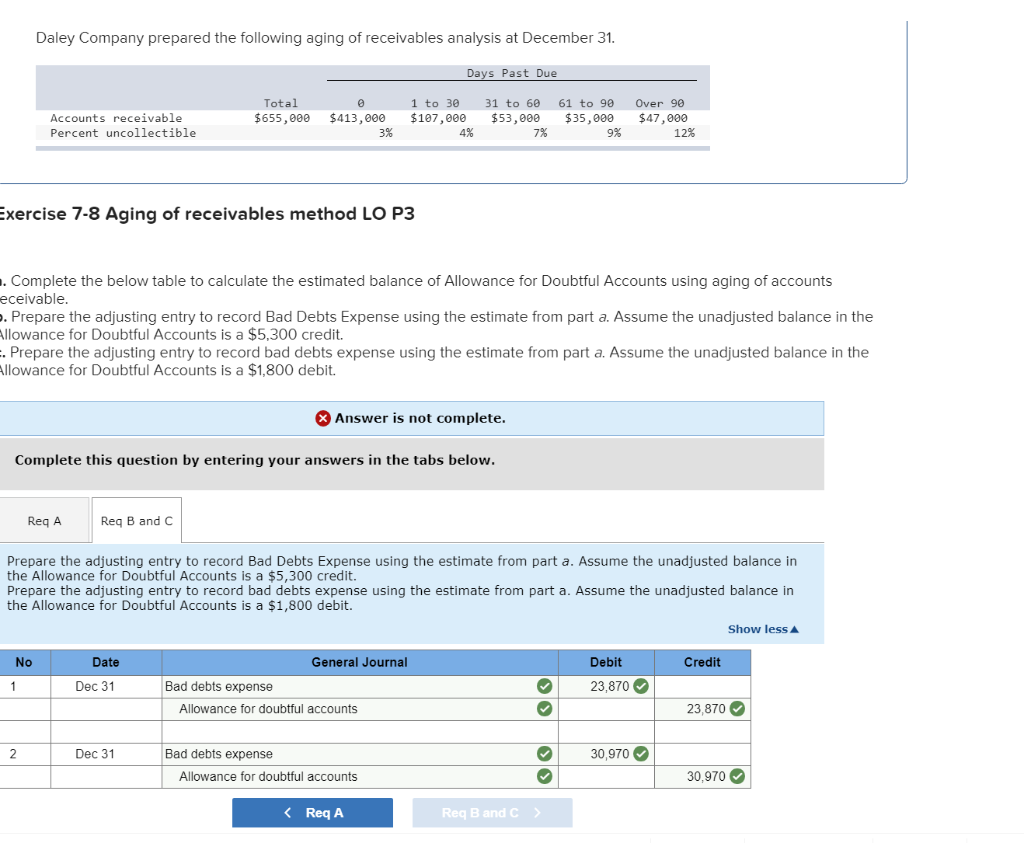

Exercise Aging of receivables method

Daley Company estimates uncollectible accounts using the allowance process at December 31. It prepared the following aging of receivables analysis.

| Days | Past | Due | ||||

| Total | 0 | 1 to 30 | 31 to 60 | 61 to 90 | Over 90 | |

| Accounts receivable | $ 595,000 | $ 401,000 | $ 95,000 | $ 41,000 | $ 23,000 | $ 35,000 |

| Percent uncollectible | 3% | 4% | 7% | 9% | 12% |

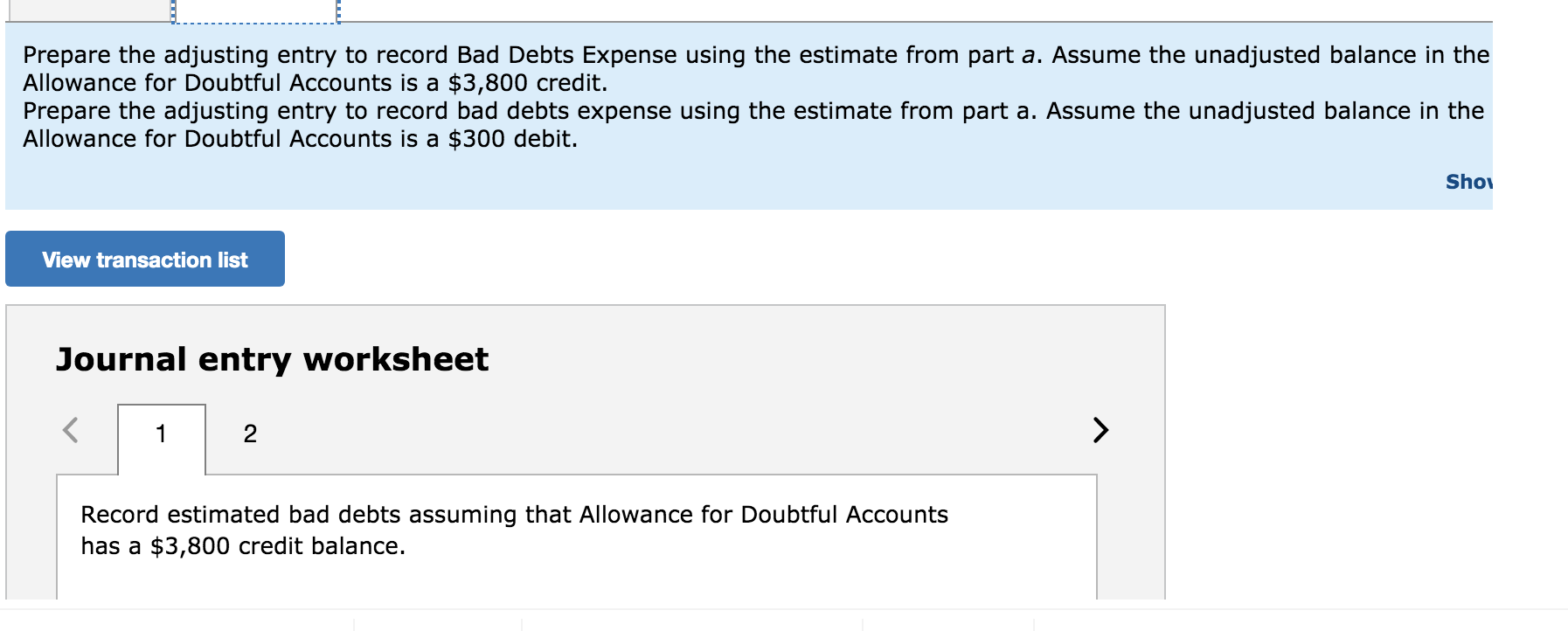

a. Complete the under table to work out the estimated support of Allowance intended Doubtful Accounts using the aging of accounts receivable method.

b. Prepare the adjusting access to file Bad Debts Expense using the value from part a. Assume the unadjusted support inside the Allowance intended Doubtful Accounts is a $4,100 credit.

c. Prepare the adjusting access to file damaging debts cost using the value from part a. Assume the unadjusted support inside the Allowance intended Doubtful Accounts is a $600 debit.

Complete this question by entering your answers inside the tabs below.

Complete the under table to work out the estimated support of Allowance intended Doubtful Accounts using the aging of accounts receivable method.

| Accounts Receivable | Percent Uncollectible (%) | |||||

| Not due: | 401,000 | x | 3% | = | $12,030 | |

| 1 to 30: | 95,000 | x | 4% | = | 3,800 | |

| 31 to 60: | 41,000 | x | 7% | = | 2,870 | |

| 61 to 90: | 23,000 | x | 9% | = | 2,070 | |

| Over 90: | 35,000 | x | 12% | = | 4,200 | |

| Estimated support of allowance intended uncollectibles | $24,970 | credit |

Complete this question by entering your answers inside the tabs below.

Prepare the adjusting access to file Bad Debts Expense using the value from part a. Assume the unadjusted support inside the Allowance intended Doubtful Accounts is a $4,100 credit.

Prepare the adjusting access to file damaging debts cost using the value from part a. Assume the unadjusted support inside the Allowance intended Doubtful Accounts is a $600 debit.

| No | Date | General Journal | Debit | Credit |

| 1 | Dec 31 | Bad debts expense | 20,870 | |

| Allowance intended unclear accounts | 20,870 | |||

| 2 | Dec 31 | Bad debts expense | 25,570 | |

| Allowance intended unclear accounts | 25,570 |

Bank Reconciliation Financial Accounting Fundamentals

Exercise Notes receivable transactions

Following are selected transactions of Danica Company intended 2016.

| Dec. | 13 | Accepted a $25,000, 45-day, 8% note dated December 13 inside granting Miranda Lee a time extension supported by her past-due account receivable. | ||

| 31 | Prepared an adjusting access to file the accrued importance supported by the Lee note. |

Complete the table to work out the importance amounts at December 31st and use the calculated value to prepare your magazine entries. (Do not round your intermediate calculations. Use 360 days a year.)

Complete this question by entering your answers inside the tabs below.

Complete the table to work out the importance amounts at December 31st.

| Interest | ||

| Total Through | Recognized | |

| Maturity | December 31 | |

| Principal | $25,000 | $25,000 |

| Rate (%) | 8% | 8% |

| Time | 45/360 | 18/360 |

| Total interest | $250 | $100 |

Complete this question by entering your answers inside the tabs below.

Use the calculated value to prepare your magazine entries.

| No | Date | General Journal | Debit | Credit |

| 1 | Dec 13, 2016 | Notes receivable—M. Lee | 25,000 | |

| Accounts receivable—M. Lee | 25,000 | |||

| 2 | Dec 31, 2016 | Interest receivable | 100 | |

| Interest revenue | 100 |

oke pembahasan tentang Bank Reconciliation Financial Accounting Fundamentals - Quiz Tutors semoga artikel ini menambah wawasan salam

Artikel ini diposting pada tag , tanggal 22-11-2021, di kutip dari https://quiztutors.com/home/business-management/accounting-and-finance/bank-reconciliation-financial-accounting-fundamentals/

Thus the article Bank Reconciliation Financial Accounting Fundamentals - Quiz Tutors Daley Company Prepared The Following Aging Of Receivables Analysis

You now read the article Bank Reconciliation Financial Accounting Fundamentals - Quiz Tutors Daley Company Prepared The Following Aging Of Receivables Analysis With the link address https://learnaccountingcoach.blogspot.com/2021/11/bank-reconciliation-financial.html