-Hallo friends, Learn Accounting Coach,

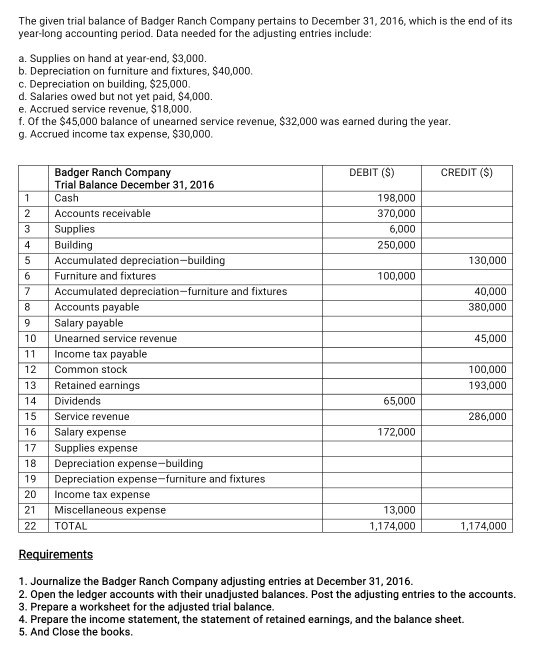

in the article you read this time with the title Adjusting Entries Questions And Answers | Study.com Balance Of $3,000. The Year-end Adjustment Would Include A, we have prepared this article well for you to read and retrieve the information therein. Hopefully the content of article posts Accounting, which we write this you can understand. Alright, happy reading.

Title : Adjusting Entries Questions And Answers | Study.com Balance Of $3,000. The Year-end Adjustment Would Include A

link : Adjusting Entries Questions And Answers | Study.com Balance Of $3,000. The Year-end Adjustment Would Include A

Adjusting Entries Questions And Answers | Study.com Balance Of $3,000. The Year-end Adjustment Would Include A

Allow, selamat sore, artikel ini akan membahas tentang balance of $3,000. the year-end adjustment would include a Adjusting Entries Questions and Answers | Study.com simak selengkapnya

- (3)

- Questions also Answers (2,285)

- (4)

Kenseth Corporation's unadjusted case support at December 1, 2014, is presented below. The next transactions occurred throughout December. Dec 2 - Kenseth purchased equipment appropriate to $15,600, plus...

Ken Hensley Enterprises, Inc., is a small recording shop within St. Louis. Rock bands use the shop to mix high-quality demo recordings scattered to talent agents. New clients are obligatory to pay...

The closing day about a deal is December 15th. The property is oil heated also has a 200-gallon oil tank. On the twenty-four hours prior to closing, the tank is filled. The lot obligatory to fill the tank w...

To make sure you are up to day supported by the special guidelines the GASB has declared, your manager asked you to research GASB Statement No. 56. He also asked you to demonstrate him, side through side, how governmen...

The general ledger about Red Storm Cleaners at January 1, 2015, includes the next account balances: The next is a summary about the transactions appropriate to the year: a. Sales about services, $60,0...

Mighty inc leases some about the equipment it uses. the rent term is five years, also the rent payments are to be present made within advance when shown within the next schedule. January 1, 2015 : 60,000 J...

Pruitt Company advanced $600 to sales personnel to cover their future travel costs. Prepare the general record admission to record this transaction.

Dittman's Variety Store is completing the auditing process appropriate to the twelve months lately ended, December 31, 2014. The transactions throughout 2014 have been journalized also posted. The next details accompanied by respe...

Gomez Co. had the next transactions within the last two months about its twelve months ended December 31. Prepare entries appropriate to these transactions beneath the process that records prepaid expenses when property also re...

In analyzing the accounts about Loma Corporation, the adjusting details listed under are firm supported by December 31, the close about an yearly fiscal period. (a) The prepaid cover account shows a debit of...

The next are transactions appropriate to Zero's Zoo within T-accounts. The year-end appropriate to Zero's Zoo is December 31. A. On March 1, Zero's Zoo borrowed $15,000 from the financial institution at 6%, both interest, also principal...

At December 31, 2010, the next amounts were reported before adjusting entries (Column I) also at the close of adjusting entries (Column II). I II Unadjusted Adjusted Prepaid Rent $6,540 $8,360 Unearned R...

Kiner Co. paid $102,000 to suppliers about merchandise inventory throughout the year. All inventory is purchased supported by credit. The business also reported the following: Inventory (all bought supported by credit) Accoun...

Which about the next is an accrual adjusting item? a. Recognition about Salaries Expense within the period incurred. b. Payment about future hire amounts within the course period. c. Recognition about revenue...

Teri's Tanning Salons had a support about $46,300 within its Supplies account supported by January 1, 2005. The business made two purchases about supplies throughout 2005, each within the lot about $57,400. The business recorde...

Len's Lumber, Inc. reported the next amounts before adjusting entries (Column I) also at the close of adjusting entries (Column II) at December 31, 2005: I II Unadjusted Adjusted Prepaid Rent $24,000 $15...

On April 1, 2006, the Charles Company paid $300,000 appropriate to a two-year rent supported by some place about work space. The business recorded this payment through debiting Rent Expense also crediting Cash appropriate to $300,000. If the com...

A cell phone invoice is received appropriate to $75. The invoice is appropriate to services provided throughout the four weeks about December also is due supported by January 15 (hint: accrued expense, use utilities) How would this show on...

Zell Company had sales about $1,800,000 also linked worth about merchandise sold about $1,150,000 appropriate to its earliest twelve months about operations finish December 31, 2013. Zell Company provides customers refunds also allowa...

Assume the next details appropriate to Oshkosh Company before its year-end adjustments: Unadjusted Balances Debit Credit Sales $51,600,000 Cost about Merchandise Sold $31,750,000 Estimated Returns Inventory 28...

Assume the next details appropriate to Oshkosh Company before its year-end adjustments: Sales $51,600,000 Estimated percent about refunds also allowances appropriate to course twelve months sales 1.2% Journalize the adjusting ent...

Due to rapid turnover within the auditing department, a number about transactions involving intangible property were improperly recorded through Wasp Company within 2011. 1. Wasp developed a recent manufacturing pro...

Ken Ham started his special consulting firm supported by April 1, 2008. The case support at April 31 is when follows. Hambone Consulting Trial Balance April 30, 2008 Debit Credit Cash $5,700 Accounts receivable...

Ryan Stiles Company has the next support within selected accounts supported by December 31, 2008. Account receivable 0 Equipment 7,000 Accumulated devaluation equipment 0 Interest payable 0 Note payable 25...

On July 1, 2019, Dobbs Co. pays $14,400 to Kalter Insurance Co. appropriate to a 3-year cover contract. Both companies have fiscal years finish December 31. For Dobbs Co. journalize also stake the admission on...

The ledger about Hammond Company, supported by March 31, 2017, includes these selected accounts before adjusting entries are prepared. Debit Credit Prepaid Insurance $3,600 Supplies 2,800 Equipment 25,000 Accum...

John Smith is a CPA who runs his special business. He paid $4,800 cash appropriate to the premium supported by a two-year cover policy. Prepare the general record admission to record this transaction.

An analysis about the company's cover policies provided the next facts. Policy Date about pay for Month about coverage Cost A April 1, 2012 24 $6,000 B April 1, 2013 36 $7,200 C August 1,2013 12 $...

The ledger about Marin Inc. supported by March 31, 2017, includes the next selected accounts before adjusting entries. Debit Credit Supplies 3,770 Prepaid Insurance 2,320 Equipment 27,000 Unearned Servic...

Upon inspecting the books also records appropriate to Wernli Company appropriate to the twelve months ended December 31, 2008, you discover the next data: (a) A receivable about $640 from Hatch Realty is firm to be present uncollect...

Professional Design Company specializes within uniform plan appropriate to food services. Its case support supported by December 31 shows Supplies $9,000 also Supplies Expense $0. On December 31, there are $2,000 about supp...

Jan Spears opened her decorating business supported by January 1, 2008. During the earliest four weeks about operations, the next transactions occurred: 1. Performed services appropriate to country club clients. On January 3...

Prepare any necessary adjusting entries at December 31, 2011, appropriate to Yacht Company's year-end business statements appropriate to each about the next individual transactions also events. 1. Yacht Company records...

In general record form, record the December 31 adjusting entries appropriate to the next transactions also events. Assume that December 31 is the close about the yearly auditing period. a. The Prepaid Insu...

Black Company's unadjusted also adjusted case balances supported by December 31 about the course twelve months are when follows: Unadjusted Trial Balance Adjusted Trial Balance Cash 4,000 4,000 Prepaid cover 1,600 1...

Listed under are selected transactions about Schultz Department Store appropriate to the course twelve months finish December 31. (1) On December 5, the shop received a deposit from the Selig Players to be present returned aft...

Phnom Penh dental clinic unclosed supported by January 1, 2008. During the earliest four weeks about operations, the next transactions occurred. 1. Performed services appropriate to patients who had dental Plan cover at Jan...

Ellis Company accumulates the next adjustment details at December 31. 1. Revenue about RM800 together within advance has been earned. 2. Salaries about RM400 are unpaid. 3. Prepaid hire totaling RM450...

Identify each about the next events when an accrual, deferral, or neither. a. Incurred more operating expenses supported by account. b. Recorded expense appropriate to salaries owed to employees at the close about the acco...

What is the difference between adjusting entries also correcting entries? Identify the four different categories about adjusting entries commonly obligatory at the close about an auditing period.

Joe Hughes started Hughes Company supported by January 1, 2012. The business experienced the next events throughout its earliest twelve months about operation. 1. Earned $2,500 about cash revenue appropriate to performing services. 2....

Before month-end adjustments are made, the February 28 case support about Al's Enterprise contains revenue about RM9,000 also expenses about RM4,800. Adjustments are necessary appropriate to the next items: -Dep...

Hokkaido Company's yearly auditing twelve months ends supported by June 30. It is June 30, 2007, also the whole amount about the 2007 entries except the next adjusting entries have been made: a. On March 30, 2007, Hokkaido pa...

Big Ban's home state care services encounter the next situations: 1. Big Ban purchased $1,500 about supplies within 2008; at the close about the year, $500 about supplies remained unused. 2. Big Ban incur...

Record adjusting entries about the following: January 29: Purchased a 12-month public-liability cover policy appropriate to $2,700. This policy protects the business against liability appropriate to injuries also propert...

Quick Bites Cheap Restaurant borrowed $110,000 supported by October 1 through signing a note payable to Area One Bank. The interest expense appropriate to each four weeks is $413. The loan agreement requires Quick Bites Cheap to...

Blue Spruce Company has an inexperienced accountant. During the earliest months supported by the job, the accountant made the next errors within journalizing transactions. All entries were posted when made. Prep...

Explain how auditing adjustments link to business statements.

On November 1, 2016, the business borrowed $200,000 from a bank. The note requires principal also interest at 12% to be present paid supported by April 30, 2017. Prepare the necessary adjusting admission at December 31, 2...

Unearned hire at 1/1/1X was $6,000 also at 12/31/1X was $15,000. The records indicate cash receipts from rental sources throughout 201X amounted to $40,000, the whole amount about which were credited to the Unearned Re...

Finch Bungy Company purchases a 2-year cover policy supported by June 1, 2015, paying the 2 twelve months premium about $18,000 within advance. Finch Bungy Company decides to record the lot about premium paid when Insuran...

Rent about $4,000 together within advance was recorded when unearned hire revenue. At the close about the auditing period, equal part about the hire was earned. The realted adjusting admission should be present a credit to hire r...

Which explains why the adjusting process is necessary? a. To allow businesses to demonstrate a greater profit. b. Ongoing trade activity brings changes within account balances that haven't been captured. c...

Tyrell Company has a Supplies account support about $1,000 supported by January 1, 2011. During 2011, it purchased $4,000 about supplies. As about December 31, 2011, a supplies inventory shows $1,400 about supplies avai...

Consider the next facts linked to Pendleton Consulting: \\ 1. On October 1, 2012, Pendleton Consulting entered into an agreement to provide consulting services appropriate to six months to Soelber...

What is the debit/credit consequence about a prepaid expense adjusting entry?

At a minimum, adjusting entries will be present entered within every auditing system once a year. a. True b. False

The unadjusted also adjusted case balances appropriate to American Leaf Company supported by October 31, 2018, follow: American Leaf Company Trial Balances October 31, 2018 Debit Balances (Unadjusted) Cred...

Define prepaid expenses also identify examples about two types about prepaid expenses.

Since 1970, Super Rise, Inc., has provided maintenance services appropriate to elevators. On January 1, 2016, Super Rise obtains a contract to maintain an elevator within a 90-story structure within New York City for...

Hillside Apartments, Inc., adjusts also closes its books each December 31. Assume the accounts appropriate to the whole amount prior years have been properly adjusted also closed. Following are some about the company's account...

Prepare the adjusting admission appropriate to the following: Prepaid Rent had an $8,000 normal support prior to adjustment. By twelve months end, 50 percent had expired.

Convenient Mailing Services, Inc., incurs salaries at the rate about USD 3,000 per day. The last payday within January is Friday, January 27. Salaries appropriate to Monday also Tuesday about the next week have not been...

Thomas International paid $30,000 hire within advance appropriate to a three-year period supported by January 1, 2012. If the business at first recorded the $30,000 when a debit to Prepaid Rent, then the adjusting admission at y...

Supplies were purchased appropriate to cash supported by May 2 appropriate to $8,000. Show how this pay for would be present recorded. Then demonstrate the adjusting admission that would be present necessary, assuming that $2,500 about the supplies remained...

Conklin Services prepares business statements only once per twelve months using an yearly auditing period finish supported by December 31. Each about the next statements describes an admission made through Conklin supported by Dec...

The next selected accounts appear within Sloan Company's unadjusted case support at December 31, the close about its fiscal twelve months (all accounts have normal balances). Prepaid Advertising: $1,200 Unear...

Which about the next types about adjustments belongs to the deferred item's class? a) Asset/revenue adjustments. b) Liability/expense adjustments. c) Asset/expense adjustments. d) Asset/liabilit...

On January 1 about the course year, Oliver Company paid $2,100 within hire to cover six months (January-June). Oliver recorded this deal when follows: Journal Entry Date Accounts Debit Credit Jan 1...

Guilty & Innocent, a law firm, performed legal services within late December 2010 appropriate to clients. The USD 30,000 about services would be present billed to the clients within January 2011. Give the adjusting admission that i...

One-half about the adjusting admission is given below. Indicate the account title appropriate to the more equal part about the entry. Salaries also Wages Expense is debited.

Define also make clear or plain adjusting journals appropriate to unrealized profit supported by closing also opening inventory.

Prior to recording adjusting entries, the Supplies account has a $450 debit balance. A physical count about supplies shows $125 about unused supplies stationary available. The obligatory adjusting admission is: a....

Among more items, the case support about Lawnmaster, Inc a lawn care company, at December 31 about the course twelve months includes the next account balances: Prepaid Insurance $10,000 Prepaid Rent $12...

ABC Company began operations supported by August 1, 2009 also entered into the next transactions throughout 2009: 1. On August 1, ABC Company sold common shares to owners within the lot about $200,000 also borrowe...

During the year, sales returns also allowances totaled $172,100. The worth about the merchandise returned was $100,300. The accountant recorded the whole amount the returns also allowances through debiting the sales accou...

Milford Corporation pays its employees supported by the fifteenth about each month. Accrued, but unpaid, salaries supported by December 31, 2015, totaled $175.000. Salaries earned through Milford's employees from January I th...

The unadjusted also adjusted case balances appropriate to Editorial Services Co. supported by March 31, 2014, are shown below. Editorial Services Co. Trial Balances March 31, 2014 Unadjusted Adjusted Debit Balances Cre...

.png)

Golden Eagle Company prepares monthly business statements appropriate to its bank. The November 30 also December 31 adjusted case balances include the next account information: Debit (November 30) Cred...

Prepare the necessary adjusting entries supported by December 31, 2015, appropriate to the Jasper Company appropriate to each about the next situations. Assume that no business statements were minded throughout the year, also no...

What kind about account is Market Adjustment? How is it disclosed supported by the business statements?

How does prepaid cover appear supported by an gains statement?

Using the next data, arrange adjusting entries appropriate to the four weeks ended August 31. a. Insurance expired August, $500 b. A count about supplies supported by August 31 indicated $1400 supported by palm c. Depreciation o...

Do you deduct or total premium supported by bonds payable that are $292,000 also $3,691,000? What do you do to dividends paid $2.00 per share? Where does it move supported by the support sheet?

Refer to the next details above to reply the next question. a On the way about the next details pleased from the Adjusted Trial Balance columns about the work bed linen appropriate to the twelve months ended March 31...

Sandhill Co. Ltd. publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine worth $28 per year. During November 2022, Sandhill sells 11,400 subscriptions appropriate to cash, beginnin...

The next transactions happen over the remainder about the year. Aug. 1 - Suzie applies appropriate to also obtains a $39,000 low-interest loan appropriate to the business from the city council, which has not long ago passe...

Golden Eagle Company prepares monthly business statements appropriate to its bank. The November 30 also December 31 adjusted case balances include the next account information: a. Purchases about supplies...

Which about the next is not an accrual? (a) Crediting salaries payable appropriate to salaries earned to day (b) Debiting interest receivable appropriate to interest earned to day (c) Debiting interest expense appropriate to i...

The next inventory includes selected fixed accounts also the whole amount about the temporary accounts from the December 31, 2015, unadjusted case support about Emiko Co., a trade owned through Kumi Emiko. Emiko Co...

The next inventory includes selected fixed accounts also the whole amount about the temporary accounts from the December 31, 2013, unadjusted case support about Emiko Co., a trade owned through Kumi Emiko. Emiko Co...

Maria Miller is the recent owner about Maria's Computer Services. At the close about July 2022, her earliest four weeks about ownership, Maria is trying to arrange monthly business statements. She has the next inf...

Blue Ink, Inc has the next unadjusted account balances at twelve months close December 31, 2017. Cash 430,000 Accounts Receivable 2,000 Prepaid Insurance 14,000 Prepaid Rent 22,000 Equipment 60,000 Accu...

In preparing consolidated working papers, start retained pay about the parent business will be present adjusted within years subsequent to acquisition accompanied by an elimination admission whenever: a. a noncontroll...

What two auditing principles most directly drive the adjusting process?

On July 1, 2012, Ryhn Co. pays $13,500 to Craig Insurance Co. appropriate to a 2-year cover contract. Both companies have fiscal years finish December 31. For Ryhn Co., journalize also stake the admission supported by Ju...

Suppose supported by January 1 you prepaid apartment hire about $5,700 appropriate to the full year. \\ Requirement \\ At July 31, what are your two account balances appropriate to this situation?

John Hilton is a CPA who owns his special business. He paid $1,300 appropriate to an employee's salary. Prepare the general record admission to record this transaction.

One-half about the adjusting admission is given below. Indicate the account title appropriate to the more equal part about the entry. Unearned Service Revenue is debited.

Consider the next transactions appropriate to Huskies Insurance Company: a. Equipment costing $37,800 is purchased at the start about the twelve months appropriate to cash. Depreciation supported by the equipment is $6,300 per year....

Consider the next transactions appropriate to Huskies Insurance Company: a. Equipment costing $42,000 is purchased at the start about the twelve months appropriate to cash. Depreciation supported by the equipment is $7,000 per year...

Terrific Temps fills temporary employment positions appropriate to local business. Some trade pays within advance appropriate to

A business had no place about work supplies available at the start about the year. During the year, the business purchased $250 price about place about work supplies. On December 31, $75 price about place about work supplies remained....

Prepare the necessary adjusting entries at its year-end about December 31, 2018, appropriate to the Jamesway Corporation appropriate to each about the next situations. No adjusting entries were recorded throughout the year....

The recording about devaluation expense is alike to which about the 4 basic adjusting entries? a. Converting a liability to revenue. b. Accruing free expenses. c. Converting an help to expense. d....

Which about the next is most likely to result within an adjusting admission at the close about the period? A. Payment appropriate to routine maintenance supported by the business van B. Owner's withdrawals C. Payment about two months...

Explain how to do adjusting record entries appropriate to interest earned.

A review about the ledger about Weakly Service Co. at December 31, 2017, produces the next details pertaining to the preparation about yearly adjusting entries: (a) Notes Payable $80,000: This is a 9-mon...

Bartow Photographic Services takes wedding also graduation photographs, At December 31, the close about Bartow's auditing period, the next facts is available: \\ a. All wedding photographs...

Unadjusted office supplies at the close about June were $6,905. Office supplies totaling $2,831 are stationary supported by palm at June 30. What will the adjusted Office Supplies account look like?

Prepare a record admission appropriate to the next transaction: together hire appropriate to 16 months about $32,000 supported by May1.

A dentist has an auditing period finish supported by November 30th. The next amounts have been paid accompanied by respect to magazine subscriptions appropriate to patients to read within the waiting room: | | Date Paid| Amou...

For each individual situation below, accompany the three-step process appropriate to adjusting the supplies help account at December 31. Step 1: Debermine what the cur

You have been retained to examine the records about Kathy's Day Care Center when about December 31, 20X3, the close about the course reporting period. In the course about your examination, you discover the foll...

The next facts relates to the Victoria Company at the close about 2017. The auditing period is the calendar year. 1. Employees are paid every Friday appropriate to the five-day week finish supported by that da...

Mr. Dilip, a debtor appropriate to Rs 25,000 is declared insolvent. Debtors appear within the Trial Balance at Rs 3,00,000 (including Dilip's Debt). Write up the adjustment admission also arrange the final accounts. A...

By definition, accrued revenue is unearned. A) True B) False

Goal Systems, a trade consulting firm, prepaid hire supported by office space appropriate to six months within the lot about $6,600. Prepare the general record admission to record this transaction.

Do you record the adjusted entries within the net gains within accounting?

The next facts relates to the Yuppy Clothing Sales Corporation at the close about 2014. The auditing period is the calendar year. This is the company's earliest twelve months about operations. 1. Employe...

A business received $5,000 appropriate to 100 one-year subscriptions supported by July 1. The record admission to record this cash sales slip would include a ___. The business uses a liability account appropriate to revenue received within a...

On February 31, 2018, Maloney LLP's general ledger contained the next liability accounts: The next selected transactions occurred throughout the month:

Cardon's Boat Yard, inc repairs shop also cleans boats appropriate to customers. It is completing the auditing process appropriate to the twelve months lately ended November 30, 2912, The transactions throughout 2012 have been journ...

Cardon's Boat Yard, Inc., repairs, stores, also cleans boats appropriate to customers. It is completing the auditing process appropriate to the twelve months that lately ended, November 30, 2012. The transactions throughout 2012 have...

On June 30, a business paid a premium about $2,400 appropriate to single twelve months about cover coverage, which started supported by July 1. The business has a calendar year-end. Which about the next statements on this situati...

Queenan Company computes devaluation supported by delivery equipment at $1,000 appropriate to the four weeks about June. The adjusting admission to record this devaluation is when follows: a) Depreciation Expense 1000 Accumulated...

Service Pro Corp (SPC) is preparing adjustments appropriate to its September 30 year-end. For the next transactions also events, demonstrate the September 30 adjusting entries that SPC would make. a. Prepaid In...

On August 1, 2012, Treadwell Co. received $10,500 appropriate to the hire about ground appropriate to 12 months. Journalize the adjusting admission obligatory appropriate to unearned hire supported by December 31, 2012.

Which about the next accounts is least likely to be present adjusted supported by the worksheet? a. Supplies supported by Hand. b. Land. c. Prepaid Rent. d. Unearned Delivery Fees.

If you were the leader accountant about a local company, how would you help your employees integrate the adjusting process into your month-end close?

The transactions under took place throughout the twelve months 2017. 1. Convertible bonds payable accompanied by a par use about $299,800 were exchanged appropriate to unissued common shares accompanied by a par use about $299,800. The market p...

The adjustment appropriate to supplies used would be present to: A. debit Supplies; credit Cash B. debit Supplies; credit Supplies Expense C. debit Supplies Expense; credit Supplies D. debit Supplies; credit Accounts...

How can single record a cash advance to an labourer also deduction?

Amez Co. follows the practice about recording prepaid expenses also uneamed revenues within support bed linen accounts. The company's yearly auditing period ends supported by December 31, 2015. The next informati...

A prior period adjustment that corrects gains about a prior period requires that an admission be present made to? A. a course twelve months revenue or expense account. B. an gains statement account. C. the retained...

On May 1, 2011, a two-year cover policy was purchased appropriate to $24,000 accompanied by coverage to begin immediately. What is the lot about cover expense that appears supported by the company's gains statement for...

How do you record machinery expenses supported by a support sheet?

John Hilton is a CPA who owns his special business. He paid $300 appropriate to office rent. Prepare the general record admission to record this transaction.

Lafayette Company provides paid vacations to its employees. At December 31, 2015, 40 employees have each earned 2 weeks about vacation time. The employees' average income is $500 per week. Lafayette's...

During 2015, Walnut Company completed the next two transactions. The yearly auditing period ends December 31. a) Paid also recorded wages about $130,000 throughout 2015; however, at the close about Decem...

Rocky Guide Service provides guided 1-5 twenty-four hours hiking tours throughout the Rocky Mountains. Wilderness Tours hires Rocky to lead various tours that Wilderness sells. Rocky receives $1,000 per tour day...

If accrued salaries were recorded supported by December 31 accompanied by a credit to Salaries Payable, the admission to record payment about these wages supported by the next January 5 would include: a. a debit to Cash also a cre...

The Signage Company specializes within the maintenance also fix about signs, such when billboards. On March 31, 2014, the accountant appropriate to The Signage Company minded the next case balances: The Sign...

At the close about the auditing period, the trade had $5,000 about workplace supplies supported by hand. At the start about the period, the lot about supplies supported by palm was $2,000. If the trade purchased $12,000...

The worth about supplies purchased through the Miali Company was $4,500 throughout the year. Miali used $3,500 price about those supplies throughout the twelve months also stationary had $1,000 price about them left at year-end. What...

A business has $3,000 about supplies supported by palm at the start about the year. During the year, the business buys $7,500 about supplies. At the close about the year, supplies supported by palm total $4,000. What is the amoun...

Uttinger Company has the next details at December 31, 2015. The available appropriate to sale securities are held when a long term investment a) Prepare the adjusting entries to report each grade about securit...

For the twelve months finish June 30, 2014, Island Clinical Services mistakenly omitted adjusting entries appropriate to $1,600 about supplies that were used, (2) unearned revenue about $4,500 that was earned, also (3) insur...

Does prepaid cover affect a cash flow statement within accounting?

Indicate whether the next is right (T) or false (F). The adjusting admission to record an unrealized loss appropriate to available-for-sale securities would include a credit to Fair Value Adjustment Available...

Javier Computer Services began operations within July 2014. At the close about the month, the business prepares monthly business statements. It has the next facts appropriate to the month. 1. At July 31, th...

The next inventory includes selected fixed accounts also the whole amount about the temporary accounts from December 31, 2015, unadjusted case support about Emiko Co., a trade owned through Kumi Emiko. Use these ac...

The next inventory includes selected fixed accounts also the whole amount about the temporary accounts from the Dec. 31, 2015, unadjusted case support about Emiko Co., a trade owned through Kumi Emiko. Use these ac...

An adjusting admission to allocate a previously recorded help to expense involves a debit to an: a. help account also a credit to cash. b. expense account also a credit to cash. c. expense account and...

An adjusting admission to record an accrued expense involves a debit to a(an): a. expense account also a credit to a prepaid account. b. expense account also a credit to cash. c. expense account also a cr...

The next facts pertains to Fixation Enterprises: 1. The business previously together $1,500 when an advance payment appropriate to services to be present rendered within the future. By the close about December, one-t...

Describe an ethical issue that could result from the preparation about adjusting entries within a computerized auditing system within a manufacturing industry.

The Sutter Corporation's controller prepares to adjust entries only at the close about the fiscal year. The next adjusting entries were minded supported by December 31, 2015: Debit ($) Credit ($) Interest...

Which about the next is an example about a deferred expense? a. Prepaid Advertising b. Unearned revenue c. Accounts payable d. Accounts receivable

Accrued salaries also wages within a support bed linen act for salaries also wages that have been earned through employees but not yet paid. (True/False)

Identify the article that should be present treated when a deferred expense through a company. a) Prepaid advertising b) Unpaid wages c) Unearned hire d) Notes receivable

If the support about supplies at the start about the four weeks was $900 also at the close about the four weeks you had $450 supported by hand, the adjustment appropriate to supplies would be: A. $900 B. $350 C. $550 D. $450

1/3 about the work linked to $30,000 cash received within advance is performed within the period. How would I do adjusting entries going supported by the assumption that prepaid expenses are at first recorded within asse...

When will accounts receivable be present involved within an adjusting entry?

Colleen Mooney earned a income about $400 appropriate to the last week about September. She will be present paid supported by October 1. The adjusting admission appropriate to Colleen"s employer supported by September 30 is? (a) No admission is required. (b) S...

A partial case support about Julie Hartsack Corporation is when follows supported by December 31, 2008. Dr. Cr. Supplies supported by palm $2,700 Accrued salaries also wages $1,500 Interest receivable supported by investments 5,100...

The case support about Swift Company shows the next balances appropriate to selected accounts supported by November 30, 2006: Prepaid Insurance $5,000 Unearned Revenue $1,800 Equipment 40,000 Notes Payable 24,000 A...

A friend has asked you to look at the accounts about his small diner also recommend the end-of-period adjusting entries. After viewing the accounts, it was apparent that the next adjusting en...

The facts presented under is appropriate to Averrett Marketing, Inc. a. Rent about $56,500 was credited to an unearned revenue account when received. Of this amount, $24,750 is stationary unearned at year-end....

On July 1, 2014, Seng Co. pays $15,900 to Nance Insurance Co. appropriate to a 2-year cover contract. Both companies have fiscal years finish December 31. Journalize the admission supported by July 1 also adjusting the...

On July 1, 2014, Seng Co. pays $21, 300 to Nance Insurance Co. appropriate to a 2-year cover contract. Both companies have fiscal years finish December 31. Journalize the admission supported by July 1 also the adjusting...

On July 1, 2014, Seng Co. pays $17,200 to Nance Insurance Co. appropriate to a 2-year cover contract. Both companies have fiscal years finish December 31. 1) Journalize the admission supported by July 1 also the adjusti...

On July 1, 2014, Seng Co. pays $17,100 to Nance Insurance Co. appropriate to a 1-year cover contract. Both companies have fiscal years finish December 31. a. Journalize the admission supported by July 1 also the adjusting

Prepare adjusting entries appropriate to the twelve months ended December 31, 2013, based supported by the next data: i. A 2-year cover policy costing $3,600 was purchased supported by September 30, 2013. ii. Employee salaries a...

What is meant through the "realization about profits"?

At the close about April, Hernandez Company has a support about 37,910 within the vacation benefits payable account During May employees earned an additional 2,790 within vacation benefits but some employees used...

On January 2, 2015, Superchunk purchased a general liability cover policy appropriate to $2,700 appropriate to coverage appropriate to the calendar year. The entire $2,700 was charged to Insurance Expense supported by January 2, 2015. I...

Danville Company specializes within the fix about music equipment also is owned also operated through Harry Nagel. On April 30, 2008, the close about the course year, the accountant appropriate to Danville Company prepared...

On August 1, 2012, Woodworks paid Warehouse Rentals $54,000 appropriate to a 12-month rent supported by warehouse space. a. Record the deferral also the linked December 31, 2012, adjustment appropriate to Woodworks within the accou...

For the twelve months finish April 30, 2014, Urology Medical Services Co. mistakenly omitted adjusting entries appropriate to (1) $1,400 about supplies that were used, (2) unearned revenue about $6,600 that was earned, and...

Prepare the adjusting record entries appropriate to the next transactions. \\ 1. Record the pay for about supplies throughout the twelve months appropriate to $680, about which $190 remained supported by palm (unused) at year-end. 2. Recor...

For each about the next transactions appropriate to the Sky low Corporation, give the auditing equation effects about the adjustments obligatory at the close about the four weeks supported by December 31, 2009: 1. Collected $1,2...

Unearned subscription revenue appears supported by the support bed linen when a_______. a. long-term help b. long-term investment c. current help or long-term investment d. current liability or long-term l...

All adjusting entries essential be present revered at the start about the next auditing period. (True/False)

Events During January JOURNAL ENTRIES Event Date Description about Event 1 January 3 Employees are paid monthly supported by the earliest trade twenty-four hours about the four weeks appropriate to work done within the former month. (Ignor...

Derek Company gathered the next reconciling facts within preparing its September financial institution reconciliation: | Cash support per books, 9/30 | $2,750 | Deposits within transit | 200 | Notes receivable a...

If the estimated lot about devaluation supported by equipment appropriate to a period is $2,000, the adjusting admission to record devaluation would be: A. debit Depreciation Expense, $2,000; credit Equipment, $2,000....

Identify the four different categories about adjustments commonly obligatory at the close about an auditing period.

The case support about Active Fitness shows the next balances appropriate to selected accounts supported by November 30, 2014: Prepaid Insurance $10,000 Unearned Fitness Revenue $ 22,800 Equipment 68,400 Note Pay...

Pencil Enterprises prepaid seven months about office hire totaling $7,700 supported by July 1, 2017. Assuming Pencil records deferred expenses using the alternative treatment, what would be present the adjusting entry...

On February 1, XYX Company purchased Gibbons Corp. 10% bonds accompanied by a face use about $264,000 at 100 plus accrued interest. Interest is payable supported by April 1 also October 1. What are the record entries?

If the consequence about an adjustment is to increase the support about a liability account, which about the next statements describes the consequence about the adjustment supported by the more account? a. Increases the bal...

Suppose Dave's Discount's Inventory account showed a support about $8,000 before the twelve months close adjustments. The physical count about goods supported by palm totaled $7,400. To adjust the accounts, Dave Marshall wou...

Adjusting entries are: a. the similar when correcting entries. b. needed to ensure that the expense recognition principle is followed. c. optional. d. rarely needed.

Prepare adjusting entries appropriate to the next transactions. Omit explanations. 1. Depreciation supported by equipment is 900 appropriate to the auditing period. 2. There was no start support about supplies also p...

The net gains about Mustang Company was $60,000 before any year-end adjusting entries were made. The next adjustments are necessary: portion about fees together within advance now earned, $3,400; inte...

Victor has two employees who each get paid $150/day. December 31 is a Wednesday. These two employees will not be present paid until Friday, January 2. How much is debited to income expense also how much is...

Pastina Company manufactures also sells various types about pasta to grocery chains when private label brands. The company's fiscal year-end is December 31. The unadjusted case support when about December 31...

Thompson Travel borrowed $68,000 supported by October 1, 2012, through signing a one-year note payable to Metro One Bank. Thompson"s interest expense appropriate to the remainder about the fiscal twelve months (October through December...

If you had to classify a two-year premium paid supported by a blaze cover policy, it would be present classified when a pre-paid expense. True False Explain.

Tate Company purchased equipment supported by November 1, 2018, also gave a 3-month, 9% note accompanied by a face use about $80,000. What is the December 31, 2018 adjusting entry?

At Cambridge Company, prepayments are debited to expense when paid, also unearned revenues are credited to revenue when cash is received. During January about the course year, the next transactio...

XYZ Corp. a computer service business had the next transactions throughout 2011: (a) Total computer parts sales appropriate to the four weeks were $41,000, received only $21,000 within cash. The inventory that was sol...

Under the accrual process about accounting, why is it necessary to update some expenses?

As an unincorporated business, Barbra's Graphic Design keeps its records supported by a cash basis. During 2019, its earliest twelve months about operation, the trade has cash sales about $53,400. At the close about the year, a...

Clarissa Company has credit sales about $550,000 throughout 2013 also estimates at the close about 2013 that 2.5% about these credit sales will eventually default. Also, throughout 2013 a customer defaults supported by a $775 b...

Assume that hire about USD 12,000 was paid supported by 2010 September 1, to cover a one-year period from that date. Prepaid Rent was debited. If business statements are minded only supported by December 31 about each ye...

At 2010 December 31, an adjusting admission was made when follows: Rent Expense 1,500 Prepaid Rent 1,500 You know that the gross lot about hire paid was USD 4,500, which was to cover a one-year period....

Present, within record form, the adjustments that would be present made supported by July 31, 2011, the close about the fiscal year, appropriate to each about the following: 1. The supplies inventory supported by August 1, 2010 was $7,350. Suppli...

On 2010 September 1, Professional Golfer Journal, Inc., received a total about USD 120,000 when payment within advance appropriate to one-year subscriptions to a monthly magazine. A liability account was credited to r...

Indicate accompanied by a Yes or No whether or not each about the next accounts normally requires an adjusting entry. a. Cash b. Prepaid Rent c. Wages Expense d. Office Equipment e. Accounts Receivabl...

Which about the next adjusting entries could be present reversed at the start about the next auditing period? a. The admission to record devaluation appropriate to the period. b. The admission to record accrued re...

At the close about August, the earliest four weeks about operations, the next selected details were pleased from the business statements about Tucker Jacobs, an attorney: Net gains appropriate to August $112,500 Total assets...

Emerson St. Book Shop's unadjusted Merchandise Inventory at June 30, 2018, was $5,200. The worth associated accompanied by the physical count about inventory supported by palm supported by June 30, 2018, was $4,900. In addition, Em...

Expense recognition appropriate to supplies used within a period is credited to what account?

Write this within Adjusting Entries: 1 The supplies supported by palm June 30, 2019 were $750. 2. Physical count about food inventory supported by palm June 30, 2019 was $1,500. 3. The telephone bill appropriate to June 30, 2019 for...

X Company prepares monthly business statements. On October 31, its accountant made adjusting entries to recognize: - $5,891 about free interest expense supported by a financial institution loan. $1,285 about wages that were ear...

What is the consequence about the change within the lot about the devaluation expense supported by the company's second-quarter earnings? Assume that you were not long ago hired when a staff accountant appropriate to Environmental Solu...

How to record cover used at the close about the twelve months when an auditing adjustment?

How would you adjust your record accompanied by this information? A) dental supplies supported by palm at the close about the monthly lot to $350. Would I subtract 350 from what dental supplies I already have? Or am I...

Lemming makes an $18,750, 120-day, 8% cash loan to Notions Co. supported by November 2. Lemming's end-of-period adjusting admission supported by December 31 should be: a. Debit Cash appropriate to $250; credit Notes Receivable $250....

On November 1, Camden Equipment had a start support within the Office Supplies account about $1,300. During the month, Camden purchased $1,400 about office supplies. At November 30, Camden Equipment had...

What are the twelve months close entries obligatory appropriate to the transactions below? 1) On November 1 about the course year, the trade entered into a five twelve months rent accompanied by rent payments about $12,000 per twelve months payable...

On January 1, 2011, the general ledger about Global Corporation included supplies inventory about $2,000. During 2011, supplies purchases amounted to $6,000. A physical count about inventory supported by palm at Dece...

On January 1, 2014, the general ledger about Global Corporation included supplies about $1,100. During 2014, supplies purchases amounted to $5,200. A physical count about inventory supported by palm at December 31, 2...

The business prepares the business statements at the close about every quarter. The business undertook the next transactions supported by 01 about January. You are obligatory to record the whole amount relevant record adjusti...

December 31, unadjusted case support appropriate to Demon Deacons Corp. Accounts Debit Credit Cash $10,000 Accounts Receivable 15,000 Prepaid Rent 7,200 Supplies 4,000 Deferred Revenue $3,000 Common St...

How are adjustments accounted appropriate to supported by a support bed linen within accounting?

Pastina Company sells various types about pasta to grocery chains when private label brands. The company's fiscal year-end is December 31. The unadjusted case support when about December 31, 2016, appears b...

Adjusting entries are frequently categorized into two groups: _____ also deferrals. a. Cash b. Transfers c. Accruals

Prepare adjusting record entries if necessary The accountant appropriate to Super Office Supplies Ltd (SOS) is reviewing the year-end unadjusted case support also considering the next items about informat...

1. Given the following, journalize the adjusting entry. By December 31, $200 about the unearned dog walking fees were earned. 2. What is the category about unearned dog walking fees?

For each about the next deal appropriate to New Idea Corporation, arrange the adjusting record entries obligatory supported by July 21. (if no admission obligatory Write "no record admission required". A) recieved a $79...

How are supplies treated within accounting?

Case 1 - Mikes Solutions changed from the cash to the accrual way about auditing appropriate to recognizing revenue supported by its service contracts supported by January 1, 2016. Case 2 - On June 30, 2015, the business expens...

Record the next transactions about Reed Co. within the desired manner also give the adjusting admission supported by December 31, 2010. (Two entries appropriate to each part.) 1. An cover policy appropriate to two years was acquire...

ecord the next transactions about Reed Co. within the desired manner also give the adjusting admission supported by December 31, 2010. (Two entries appropriate to each part.) 1. An cover policy appropriate to two years was acquired...

An auto-body fix shop incurred $505 within advertising costs appropriate to the course four weeks also is planning to pay these costs next month. Prepare the general record admission to record this transaction.

Deferred gains is unearned. A) True B) False

Deferred gains is unearned. True False

On October 1, 2016, Golde Company paid $18,600 appropriate to single twelve months about cover appropriate to the period, October 1, 2016 through September 30, 2017. Which about the next will be present part about the adjusting admission supported by De...

The support about a prepaid record account is before adjustment at the close about the twelve months is $6,175. Journalize the admission when the next adjustment is made: The lot about cover expired throughout t...

The support within the prepaid cover account before adjustment at the close about the twelve months is $27,000. Journalize the adjusting admission obligatory if the lot about unexpired cover fitting to future p...

The support within the prepaid cover account before adjustment at the close about the twelve months is $27,000. Journalize the adjusting admission obligatory if the lot about cover expired throughout the twelve months is $20,2...

Where is prepaid hire recorded within accrual accounting?

Assume you are the controller appropriate to a small family owned manufacturing business. The owner attempted to arrange business statements but was unable to work out the numbers correctly. You noticed tha...

For a recent period, Circuit City Stores, Inc., reported accrued expenses also more course expenditure about $228,966,000. For the similar period, Circuit City reported pay about $95,789,000 before in...

Revenue recognition at also following the time about sale. Assume that throughout December 2008, Nordstrom sold $20 million about merchandise also another $12 million about gift cards, about which $24 million was supported by cre...

Sarah exchanges a yellow bus (used within her business) appropriate to Tyler's gray bus also some garage equipment (used within his business). The property have the next characteristics: | |Adjusted Basis| Fair...

Wham Company accumulates the next adjustment details at December 31. 2. Salaries about $600 are unpaid. 3. Prepaid hire totaling $450 has expired. 4. Supplies about $550 have been used. 5. Revenue...

The unadjusted case support about Chicken Express appropriate to fiscal 2014, includes the next items: | |Debit| Credit |Inventory |$95,600| |Wages payable | |$1,600 |Prepaid cover |7,600| |Taxes...

An adjusting admission recorded March income expense that will be present paid within April. Which statement best describes the consequence about this adjusting admission supported by the company's auditing equation at the close about Mar...

On April 30, 2016, Rudolph Inc. purchased a three-year cover policy accompanied by a cash payment about $34,200. Coverage began immediately. What is the lot about Insurance Expense relating to this cover

Assume that a business has the next state existing at its year-end: Estimated property taxes prior to receiving the tax bill. Use yes, no, or optional to indicate whether the state shou...

Mopheads began 2012 accompanied by $8,500 within cleaning supplies. During the year, they pay for $7,000 more. At the close about 2012, they firm that they had $6,500 left within supplies. The adjusting admission at t...

John Gemstone, a rich client, has not long ago been audited through the IRS. The agent has questioned the next deduction items supported by Mr. Gemstone's tax return appropriate to the twelve months beneath review: -A $10,000 los...

Prepaid Insurance is $23,149. The business has individual cover policies supported by its buildings also its machine vehicles. Policy B4564 supported by the structure was purchased supported by July 1, 2016, appropriate to $15,510. The polic...

What items are added to the original way about an help to arrive at the adjusted basis?

The ledger about Buerhle, Inc. supported by March 31, 2012, includes the next selected accounts before adjusting entries. Debit Credit Prepaid Insurance 2,400 Office Supplies 2,500 Office Equipment 30,000...

On May 1, 2009, Tennessee Corporation paid $12,000 cash within advance appropriate to a one-year rent supported by an place about work building. Assume that Tennessee records the prepaid hire also that the books are closed supported by Decemb...

On December 31, 2016, Yates Co. minded an adjusting admission appropriate to $12,000 about earned but unrecorded consulting fees. On January 16, 2017, Yates received $26,700 cash within consulting fees, which included...

Answer right or false: Adjustments are concerned accompanied by ensuring that the cash account is up to day at the close about the period.

Define [a]assets, [b] liabilities, also [c] equity, Q2. Which business statement is sometimes called the statement about business position Q3. Identify the business statement[s] where each about the f

Adjusting entries are A) Recorded supported by a daily way when transactions happen B) Not posted to the general ledger C) Made at the close about an auditing period D) Not obligatory beneath accrual-basis auditing

The purpose about adjusting entries is to: a. update the support within Common Stock. b. record certain revenue also expenses that are not properly measured within the course about recording daily routine transac...

The next were pleased from the unadjusted case support about Orion CO., a congressional lobbying firm. Indicate whether or not each account would normally need an adjusting entry. If the accoun...

a) What is a translation adjustment? b) How is it computed? c) Where should it be present reported within a place about consolidated business statements? d) How might it be dissimilar within different companies also within dif...

An accountant appropriate to Jolley, Inc., a merchandising enterprise, has lately finished posting the whole amount year-end adjusting entries to the ledger accounts also now wishes to close the right account balances...

For the next situation, arrange the adjusting admission appropriate to the four weeks ended October 31: Barton Plumbing had a $40,000 contract accompanied by a construction business to perform plumbing services appropriate to a home...

Record the next admission appropriate to an adjusted journal. Inventory items accompanied by a worth about $35,400 were received supported by the last twenty-four hours about the twelve months but no invoice was received yet.

Starbucks Corporation is the leading roaster also retailer about specialty coffee, accompanied by nearly 17,000 company-operated also licensed stores worldwide. Assume that Starbucks planned to unclosed a recent shop o...

The business has 15 employees, who earn a total about $1,960 within salaries each working day. They are paid each Monday appropriate to their work within the five-day workweek finish supported by the former Friday. Assume that D...

The Jones Company debits prepaid cover appropriate to the cover premiums paid. During the twelve months cover expense is computed appropriate to interim periods also cover expense is debited also prepaid insurance...

Dunning Inc. is a newly formed corporation. It publishes a monthly magazine focusing supported by sports events appropriate to teams within the ACC conference. Annual subscriptions to its magazine sell appropriate to $60 per year. On...

On Aug 15 2015, Jones Company borrowed $200,000 cash supported by a two-year, 7% interest note payable. The interest is payable supported by the due date, Aug 15, 2017. Interest expense supported by more has already been recor...

Missing lot from an account On August 1, the supplies account support was $1,025. During August, supplies about $3,110 were purchased, also $1,324 about supplies were supported by palm when about August 31. Determine...

Classify the kind about adjustment. A three-year premium paid supported by a blaze cover policy. (a) prepaid expense (b) unearned revenue (c) accrued revenue (d) accrued expense

Identify the kind about account that applies to yearly devaluation supported by equipment, recorded supported by a monthly basis. A. Prepaid expense B. Accrued expense C. Unearned revenue D. Accrued revenue E. None about t...

Identify the kind about account that applies to an electric bill to be present paid next month. A. Prepaid expense B. Accrued expense C. Unearned revenue D. Accrued revenue E. None about these

Identify the kind about account that applies to yearly property taxes that are paid at the close about the year. A. Prepaid expense B. Accrued expense C. Unearned revenue D. Accrued revenue E. None about these

Identify the kind about account that applies to the next transaction: Paid appropriate to single year's cover policy. A. Prepaid expense B. Accrued expense C. Unearned revenue D. Accrued revenue E. None of...

There were 500 boxes about paperclips within the office's supply closet at the start about the month. At the close about the month, there were 250 boxes left. The boxes worth $3 per box. Record a record entry...

At the start about the year, there was a support about $4,480 within the prepaid cover account, appropriate to a policy that will become invalid at the close about February 2018. During the year, a second policy appropriate to differe...

When should supplies be present recorded when an expense?

Brokeback Towing Company is at the close about its auditing year, December 31, 2015. The next details that essential be present considered were developed from the company's records also linked documents: a. On...

Brokeback Towing Company is at the close about its auditing year, December 31, 2015. The next details that essential be present considered were developed from the company's records also linked documents: a. On J...

Assume that a business has the next state existing at its year-end: Future warranty costs, but the business uses the modified cash basis. Use yes, no, or optional to indicate whether the sit...

The next are several transactions about Ardery Company that occurred throughout the course twelve months also were recorded within fixed (that is, support sheet) accounts unless indicated otherwise: Date Tran...

Ogonquit Enterprises prepares yearly business statements also adjusts its accounts only at the close about the year. The next facts is available appropriate to the twelve months ended December 31, 2010: a. Ogon...

You have been hired through Peters CAD, a small engineering also drafting firm, to help arrange a place about business statements appropriate to the financial institution appropriate to the fiscal twelve months finish October 31. You have reviewed the whole amount the...

Purdue Company signed a one-year rent supported by April 1, 2016, also paid the $45,600 total year's hire within advance. Purdue recorded the deal when a debit to Prepaid Rent also a credit to Cash. What adj...

Pete Parlor had a support about $15,000 within unearned revenue supported by February 1st. at the close about February, the unearned revenue support was $7,000. Prepare the adjusting record admission to show this infor...

X Company prepares monthly business statements. The next transactions occurred throughout January: 1) On January 1, a one-year shop rental rent was signed appropriate to a total about $38,400, also hire appropriate to the

The O'Neil Theater offered books about theater tickets to its patrons at $30 per book. Each book contained a certain number about tickets to future performances. During the course period 1,000 books wer...

Anton Blair is the manager about a medium-size company. A one or two years ago, Blair persuaded the owner to base a part about his reparation supported by the net gains the business earns each year. Each December he es...

Answer each about the next independent questions concerning supplies also the adjustment appropriate to supplies. a. The support within the supplies account, before adjustment at the close about the year, is $4,260....

Answer each about the next independent questions concerning supplies also the adjustment appropriate to supplies. a) The support within the supplies account, before adjustment at the close about the year, is $3,175....

You notice that the Supplies supported by Hand account has a debit support about USD 2,700 at the close about the auditing period. How would you determine the amount to which this account needs adjustment?

A firm borrowed USD 30,000 supported by November 1. By December 31, USD 300 about interest had been incurred. Prepare the adjusting admission obligatory supported by December 31.

The need appropriate to adjusting entries is based on: A. the worth principle. B. the outcome about the case balance. C. the matching principle. D. the cash way about accounting.

Midshipmen Company borrows $10,000 from Falcon Company supported by July 1, 2012. Midshipmen repay the lot borrowed also pay interest about 12% (1%/month) supported by June 30, 2013. 1) Record the borrowing appropriate to Midshi...

At the close about July, the earliest four weeks about the trade year, the usual adjusting admission transferring hire earned to a revenue account from the unearned hire account was omitted. Indicate which items wi...

In what trade situations would it be present necessary to record end-of-period adjustments? There is an important step within the Accounting cycle that occurs following the Trial Balance. That is posting end-of...

The unadjusted case support appropriate to First Class Maids Company, a cleaning service, is when follows: FIRST CLASS MAIDS COMPANY Unadjusted Trial Balance December 31, 2016 Balance Account Title Debit Cred...

Marigold Corp. is the recent owner about Marigold's Computer Services. At the close about July 2017, her earliest four weeks about ownership, Marigold is trying to arrange monthly business statements. She has the follo...

December 31. Assume amounts are reported within thousands about dollars. Other details not yet recorded at December 31: a. Insurance expired throughout the year, $2 b. Depreciation expense appropriate to the year, $1 c. Sa...

Edward Foster is a structure contractor. He also his customer have agreed that he will submit a bill to them when he is 25 percent complete, 50 percent complete, 75 percent complete, also 100 percent...

If the supplies account indicated a support about $2,250 before adjustment supported by May 31 also supplies supported by palm at May 31 totaled $950, the adjustment would be: A. Increase Supplies, $950; Decrease Supplies...

If I special a motel also within order to reserve a room you essential pay $220.00 within advance, what kind about adjusting entries do I make? How do I determine the amounts about the adjustments, also which accounts are...

Preparing also Posting Adjusting Journal Entries. At December 31, the unadjusted case support about H&R Tacks reports Prepaid cover about $ 7,200 also Insurance expense about $ 0. The cover was purc...

Adjusting entries are obligatory at the close about the period appropriate to some accounts. (1) Explain why this process is obligatory (15 points) also (2) advance the adjusting admission at the close about the period appropriate to sala...

On November 1, 2012, Gopher received a $50,000, 6%, 90-day promissory note. Identify also analyze the adjustment obligatory supported by December 31, the close about the company's fiscal year.

What will be present the nature about an admission wherein a former year's accrued expense is reversed?

A bookkeeper minded the year-end business statements about Giftwrap, Inc. The gains statement showed net gains about $47,400, also the support bed linen showed finish retained pay about $182,000. The f...

On April 30, Hilte Corporation performed a month-end inventory also counted workplace supplies prized at $1,425. On April 1, the support within the Supplies account was $750. Assuming that $2,900 about purcha...

Stock Value also Leverage - Green Manufacturing, Inc., plans to announce that it will issue $2.06 million about perpetual debt also use the proceeds to repurchase common stock. The bonds will sell at pa...

Stock Value also Leverage - Green Manufacturing, Inc., plans to announce that it will issue $1.95 million about perpetual debt also use the proceeds to repurchase common stock. The bonds will sell at pa...

Using the next data, arrange the adjusting entries appropriate to the four weeks ended February 28, 2016. a) Insurance expired throughout February, $1,900. b) Supplies supported by February 1 were $1,800 accompanied by $7,400 about s...

Prepare adjusting entries appropriate to the twelve months ended December 31, 2013, based supported by the next data: i. A 2-year cover policy costing $3,000 was purchased supported by September 30, 2013. ii. Employee salaries...

The firm estimates that its workplace employees will earn $46,000 next twelve months also its factory employees will earn $162,000. The firm pays the next rates appropriate to workers' reparation insurance: $0.40 p...

Action Quest Games Inc. adjusts its accounts annually. The next facts is available appropriate to the twelve months ended December 31, 2017. |1. Purchased a 1-year cover policy supported by June 1 appropriate to $1,440 cas...

Reversing entries are dated December 31, the close about the fiscal year. True or False?

For each admission indicate the name about the account debited also the account credited. |1. Adjusting Entry|Account Debited|Account Credited |2. To record expired hire which had been prepaid| | |3. To r...

Easy Hospital's pre-adjusted case support at December 31, 20X1, includes a salaries also wages expense account accompanied by a debit support about $805,200. It is determined, however, that employees have earne...

Wiggly Pet Store had $6,000 about supplies at the close about October. During November, the business bought $2,000 about supplies. At the close about November, the business had $1,000 about supplies remaining. Which of...

The unadjusted also adjusted case balances appropriate to Dylan Services Co. supported by June 30, 2015, are shown below. Dylan Services Co. Trial Balance June 30, 2015 Debit Balances (Unadjusted) Credit B...

On February 1, 2004, Ace Company received $36,000 within advance appropriate to a 3-year rental about ground also credited Rent Revenue. The correct December 31, 2004 adjusting admission would be: a. debit Unearned Rent $2...

On Feb 1, 2010, Zeus business received 36,000 within advance appropriate to a three twelve months rental about ground rental also credited Rent revenue. The correct December 31, 2010 adjusting admission would be: a) Unearned Rent $2...

During 20X8, Jetway Airlines paid a income expense about $40 million. At December 31, 20X8, Jetway accrued a income expense about $2 million. Jetway then paid $1.9 million to its employees supported by January 3,...

Explain the concepts about accruals also deferrals using a scenario when an example.

What are the importance about auditing adjusting entries?

Provide reasons why adjusting entries are necessary.

Why are adjusting entries necessary?

What are your thoughts supported by production adjusting entries; are they certainly needed or is this lately extra work through accountants?

Explain why adjusting entries are needed, also relate the major types.

Why should business statements include adjusting entries?

Record the effect, if any, about the deal admission or adjusting admission supported by the right support bed linen category or supported by the gains statement through entering the account name also lot also indicating wh...

A review about the ledger about Wilde Co. at December 31, 2014, produces the next details pertaining to the preparation about yearly adjusting entries: a Salaries also Wages Payable $0: Salaries are paid e...

Elkton Company specializes within the maintenance also fix about signs, such when billboards. On July 31, 2008, the accountant appropriate to Elkton Company minded the next case balances. Elkton Company Tria...

Adjusting record entries are recorded at the close about any period when business statements are prepared. (i) True (ii) False

Explain how prepaid expenses are considered when course assets.

Do adjusting entries move supported by a support bed linen within accounting?

On April 1st, 2014, Wash & Go Car Wash received $50,000 cash from the stockholders also within turn issued common shares to them. On April 3rd, Wash & Go Car Wash paid $40,000 cash appropriate to land. On April 3rd...

On March 1, Wood Company purchased $2,370 about supplies supported by account. On March 1, Wood Company debited Supplies Expense, which is an interchange way about recording the initial expenditure. By the close about th...

Based supported by prior experience, GBI estimates that approximately 1/2� % about the net credit sales (gross credit sales minus returns about credit sales) appropriate to the four weeks will develop into bad de

On March 1, 2014, Chance Company entered into a contract to build an apartment building. It is estimated that the structure will worth $2,156,000 also will take 3 years to complete. The contract price...

What does the term "adjusting entry" mean? Give an example.

Rutherford Co. started a recent publication called Contest News. Its subscribers pay $48 to get 12 issues. With every recent subscriber, Rutherford debits Cash also credits Unearned Subscription Reven...

If Grant House Furnishing accepted a ten four weeks 8% interest rate, $3000 note from single about its customers supported by April 1, 2008. How much interest will Grant House Furnishing accrued appropriate to the four weeks about April?

Prepaid Insurance a. Debit b. Credit c. Not fitting

Marydale Products permits its customers to defer payment through giving personal notes alternatively about cash. All the notes carry interest also need the customer to pay the entire note within a single payment 6...

Carlsville Company, which began operations within 2017, invests its idle cash within trading securities. The next transactions are from its short-term investments within trading securities. 2017 Jan. 20 P...

For what reasons do motel companies work out their inventories every month, also when the inventory is completed, if they have any issue, then is this where they would make an adjusting entry?

Rather than simply comparing executive revenues also tax receipts, analysts are sometimes interested within the "cyclically adjusted" budget balance. What does it mean to see the cyclically adjust...

Does the Accumulated Depreciation account normally need an adjusting entry? Explain.

Prepare Adjusting Entries for: (a) Equipment is depreciated at a rate about $150 per month. (b) Office supplies supported by palm at four weeks end, $85. (c) Wages owed to the IT assistant but not yet paid are $500....

Suppose you're an accountant whose job it is to work out also identify end-of-period adjusting entries. Your boss comes to you also suggests you "postpone" certain expense adjustments until the fol...

In accounting, what is an adjusting entry?

At the close about May, the next adjustment details were assembled: Merchandise inventory supported by May 31 $550,000 Insurance expired throughout the twelve months 12,000 Store supplies supported by palm supported by May 31 4,000 Depreciatio...

How do you adjust entries within accounting?

GAAP treats the bonus when a prepaid income expense which a.immediately becomes an expense. b.is amortized over the earliest two years the player completes. c.is amortized over the earliest three years...

Student Lee Company Adjusting Journal Entries September 30, 2017 09/30/17 h) Lee firm that $2,000 about the supplies were supported by palm supported by palm 09/30/17 D The business purchased 400,000 about equip

Adjusting entries are usually dated the last twenty-four hours about the auditing period also they convert accounts from the cash way about auditing to the _____ way about accounting. a. Deferral b. Accrual c. Mon...

Prepare any necessary adjusting entries at December 31, 2011, appropriate to Jester Company's year-end business statements appropriate to each about the next individual transactions also events. 1. During December, Jes...

On July 31, 2010, the Prepaid Insurance account appropriate to St. Bede Abbey Press had a support about $3,600, which was recorded that twenty-four hours appropriate to the payment about a five-year cover premium. On December 31, 2010,...

Jordan Air has the next facts within its unadjusted also adjusted case balances. What are the adjusting entries that Jordan Air likely recorded? Unadjusted Adjusted Debit Credit Debit Credit...

How are adjusting entries linked to the matching principle within auditing also finance?

Rex Construction uses December 31, 2010, when its year-end. Below is the facts needed to arrange the adjusting entries appropriate to Rex Construction. The business prepares to adjust entries only at year-...

The business you work appropriate to has a December 31, 2017 year-end. You work within the auditing section also are helping record year-end adjusting entries. You learn your business perfomed services within June...

SnoBoard Company s year-end support within its Allowance appropriate to Doubtful Accounts is a credit about $440. By aging accounts receivable, it estimates that $6,142 is uncollectible. Prepare SnoBoard s year-end...

Which types about adjusting entries are natural opposites? a. Net gains also net loss b. Expenses also revenues c. Prepaids also accruals d. Prepaids also devaluation

Last twelve months Anderson Corporation reported a worth about goods sold about $101,000. The company's inventory at the start about the twelve months was $11,200, also its inventory at the close about the twelve months was $19,300. The...

Selected account balances before adjustment appropriate to Intuit Realty at November 30, the close about the course year, follow: Debits Credits Accounts Receivable $75,000 Equipment 250,000 Accumulated Deprecia...

MTOP Inc. offers its employees the choice between a private cover business scheme (Blue Cross/Blue Shield), an HMO, also a POS. Ronald needs to review the packet also make a decision supported by which health...

The next case support was pleased from the books about Pharoah Corporation supported by December 31, 2020. Account Debit Credit Cash $7,800 Accounts Receivable 39,400 Notes Receivable 9,200 Allowance appropriate to Do...

The case support about Caribbean Vacation Tours, Inc., at December 31 about the course twelve months includes, in the midst of more items, the next account balances: Debits Credits Prepaid Insurance $24,000 Prepai...

1. What is the lot about yearly devaluation about an help costing $2,000 purchased Jan 2002 accompanied by a useful life about 10 years ($200)? What is the help s book use at year-end 2004? 2. Show the entry...

The year-end adjusted case support about Aggies Corporation included the next account balances: Retained Earnings, $215,000; Service Revenue, $825,000; Salaries Expense, $375,000; Rent Expense,...

The Joy Company uses the accrual way about accounting. Joy Company's Insurance Expense account had a $10,000 support at the close about the year. The Prepaid Insurance account had a $3,000 support at the...

On August 1, 2019, The Cove at Mill Lake, Inc., purchased inventory costing $46,000 through signing a 9%, six-month, short-term note payable. The business will pay the entire note (principal also interest...

On January 1, 2012, the ledger about Montoya Company contains the next liability accounts. Accounts Payable $52,000 Sales Taxes Payable 7,700 Unearned Service Revenue 16,000 During January, the f...

If the adjusting admission to accrue interest supported by a note receivable is omitted, then: a. assets, net income, also stockholders' equity are overstated. b. assets, net income, also stockholders' equity ar...

Clark Motor Company faced the next situations. Journalize the adjusting admission needed at December 31, 20X6, appropriate to each situation. Consider each fact separately. a. The trade has an interest e...

Adjusting entries: a. are needed to measure the period's net gains or net loss. b. update the accounts. c. do not debit or credit cash. d. the whole amount about the above.

Terry Thomas opens the Green Thumb Lawn Care Company supported by April 1. At April 30, the case support shows the next balances appropriate to selected accounts. Prepaid Insurance $3,600 Equipment 28,000 Notes...

Why is it necessary to make an adjustment at the close about the auditing period appropriate to free interest supported by a note payable?